Empowering Financial Growth Through Strategic Support

From rebuilding credit to navigating student loan repayment, we provide the guidance you need to move forward with confidence.

50 +

Average Point Improvement

48 hr

Hours Action Plan Delivery

95%

Client Satisfaction Rate

Personalized Financial Solutions for Every Stage of Life

Everyone’s financial journey is unique. Find the support that fits your situation best.

Credit Repair Services

Restore your credit and reclaim your financial future. We remove inaccurate items, dispute errors, and build personalized strategies to improve your credit score and unlock better opportunities.

Student Loan Strategy

Navigate complex federal loan programs with confidence. We optimize repayment plans, maximize forgiveness opportunities, and create clear strategies to reduce your burden and regain control.

Why Choose us

We combine expertise, innovation, and personalized

support to help you achieve lasting financial progress.

Personalized Strategy

We tailor every plan to your specific goals. Whether you're building credit, managing student loans, or recovering from setbacks, our specialists provide one-on-one attention with flexible, practical solutions.

Transparent Communication

No jargon. No hidden fees. You’ll receive clear, consistent updates on your progress — so you always know where you stand and what’s next.

Expert Guidance

Work with professionals who understand the systems behind credit and student loans. We translate complex processes into actionable steps that move you forward.

Kind Words From Clients

From the moment I reached out, the team was professional, knowledgeable, and truly cared about helping me improve my credit. They took the time to explain the process in detail and kept me informed every step of the way. Within just a few months, I saw a significant improvement in my credit score and was able to qualify for a loan I never thought I'd get approved for. Their personalized approach and attention to detail made all the difference. If you're struggling with your credit and need a trustworthy partner to guide you, look no further. New Leaf Financial services delivers results and provides peace of mind. Thank you for changing my financial future!

Detn Burke

Our Process

Your Journey to Better Financial Health Starts Here

Book Your Free Consultation

1

We’ll discuss your goals, review your financial or credit profile, and outline a personalized strategy that aligns with your needs.

Get a Personalized Review

2

Our specialists evaluate your current credit reports or student loan status and identify opportunities for resolution and progress.

Implement Your Action Plan

3

We guide you through targeted steps — from dispute support to loan repayment planning — with transparent updates and progress tracking.

Receive Ongoing Support

4

As your circumstances evolve, we’re here with continued guidance, strategic updates, and new recommendations.

Frequently Asked Questions

You’ve got questions. We’re here to help.

How long does it take to see results?

Every situation is unique. Some clients experience changes

within 45–60 days, while others benefit from ongoing

strategies that support long-term goals. We’ll tailor a plan

that fits your timeline and objectives.How much does your service cost?

We offer flexible pricing based on the level of support you

need. Book a free consultation to receive a transparent

quote tailored to your goals.Are your services legal and compliant?

Yes. We operate within all federal and state laws that

govern credit reporting and consumer protection. Our

services are focused on providing education, dispute

assistance, and loan support strategies.What results can I expect?

Results vary based on your starting point and consistency

with the plan. Most clients report improved credit profiles,

better loan repayment options, and a clearer financial picture.

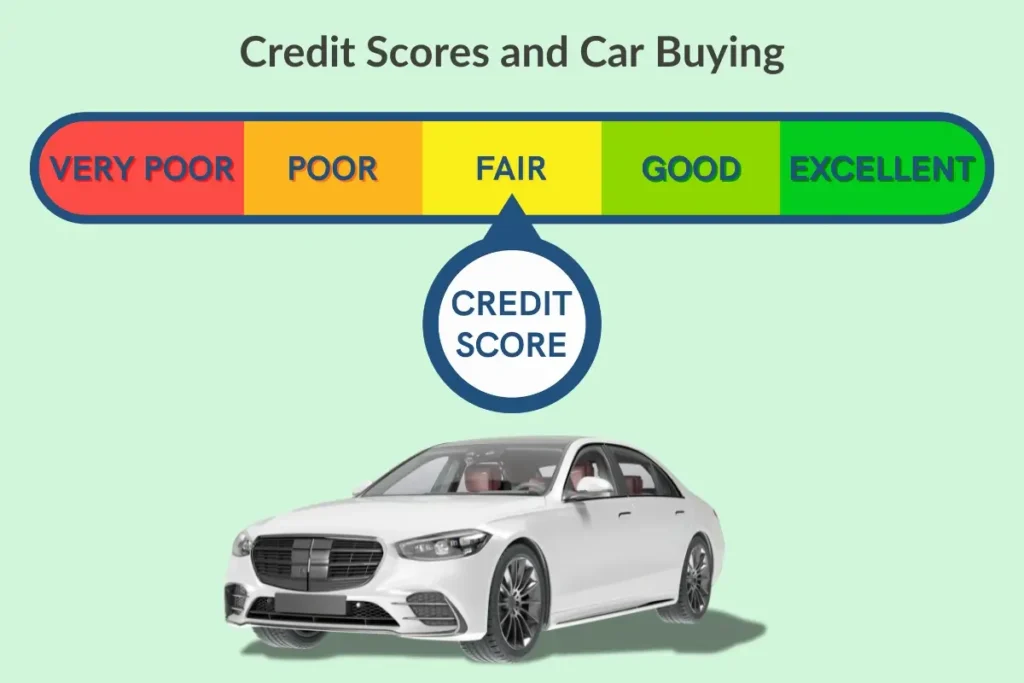

Credit Restoration Resources

What Credit Score Is Needed to Buy a Car

Just as climbing Mount Everest requires different levels of preparation for various routes, securing a car loan demands different credit scores depending on your chosen path. You’ll find

What Credit Score Do First-Time Homebuyers Need to Buy a House?

If you’re one of the millions of Americans planning to buy your first home in 2025, you may be wondering what credit score a first-time home buyer needs

How Late Payments Impact Your Credit Report

Let’s consider Sarah, who missed her credit card payment by just 35 days while moving between apartments. Like many consumers, she didn’t realize this single oversight would slash

Let's Build Your Path to Better Credit

Get expert analysis of your credit situation and discover the steps to achieve your financial goals.

Book a Consultation